Garware Technical Fibres Ltd: Q1 Earnings Miss Estimates, But Analyst Optimism Grows for 2025

Garware Tech Fibres Limited: Overview

Garware-Wall Ropes (GWRL), founded in 1976, is one of India’s premier technical textiles companies, offering specialist solutions to the cordage and infrastructure industries around the world. The company produces and supplies high-performance polymer ropes, fishing nets, sports nets, safety nets, aquaculture cages, coated fabrics, agricultural netting. The company is among top 50 companies and top 20 in Technical textile manufacturing companies in India. The business segments and their revenue contributions are: Synthetic Cordage 82%, Fibre and Industrial Products & Projects 18%. The clients are working in area of fishing, shipping, aquaculture, coated fabrics, and government sectors. It has two manufacturing facilities located in Pune and Wai with capacity of 80 MT per day of technical fabrics. The company is in 75+ countries with 21,000+ SKUs and export contributes about 60% of its revenue.

Latest Stock News (04-Jan-2025)

The company had announced a 4:1 bonus issue of shares earlier. This means that shareholders will be eligible for four bonus shares for every one share that they hold. This is the first time that the company had announced a bonus issue of shares. Since 2021, the company has also paid ₹16 per share as dividends and also carried out a buyback of equity shares earlier in 2024. The stock will be trading on its ex-bonus price from 6 January, 2025.

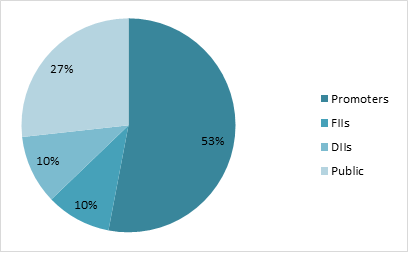

Shareholding Pattern as on September 2024

Key Stats

| Market Cap | ₹9047 Crore |

| Revenue | ₹1428 Crore |

| Profit | ₹226 Crore |

| ROCE | 23.07% |

| P/E | 40.3 |

Peer Comparison

| Amt in ₹ Cr | MCap | Sales | PAT | ROCE | Asset Turn. | EV/EBITDA | D/E | P/E |

| Garware Tech | 9047 | 1428 | 226 | 23.07% | 0.81 | 26.51 | 0.13 | 40.12 |

| Jindal Poly Film | 4249 | 4604 | 149 | 3.15% | 0.39 | 12.23 | 1 | 28.59 |

| Welspun Living | 15888 | 10398 | 693 | 16.1% | 1.07 | 11.72 | 0.69 | 22.9 |

| S P Apparels | 2278 | 1184 | 86 | 13.5% | 0.97 | 15 | 0.41 | 26.5 |

| Monte Carlo Fas. | 1626 | 1056 | 54 | 10.63% | 0.7 | 13.56 | 0.89 | 30.2 |

Financial Trends

| Amount in ₹ Cr | 2020 | 2021 | 2022 | 2023 | 2024 |

| Revenue | 953 | 1035 | 1189 | 1306 | 1326 |

| Expenses | 775 | 830 | 966 | 1076 | 1054 |

| EBITDA | 178 | 204 | 223 | 230 | 272 |

| OPM | 19% | 20% | 19% | 18% | 21% |

| Other Income | 32 | 35 | 25 | 28 | 43 |

| Net Profit | 141 | 158 | 165 | 172 | 208 |

| NPM | 14.8% | 15.3% | 13.9% | 13.2% | 15.7% |

| EPS | 12.85 | 15.36 | 15.98 | 16.9 | 20.43 |

Stock Price Analysis

In terms of performance, Garware Technical Fibres has shown a return of -1.78% in one day, -81.24% over the past month, and -77.54% in the last three months. The stock has experienced fluctuations today, with a low of ₹885 and a high of ₹962.95. Over the past 52 weeks, the shares have seen a low of ₹623.22 and a high of ₹985.16, the volatility is stable and the price is in the growth trend as the financials are performing better.